Ethereum has had a rough week, tumbling 15% and dropping to $3,377. With losses climbing to over $23 billion, the market is buzzing with questions—what’s causing the sell-off, and where is Ethereum headed next?

What’s Happening with Ethereum?

Massive Losses Mounting

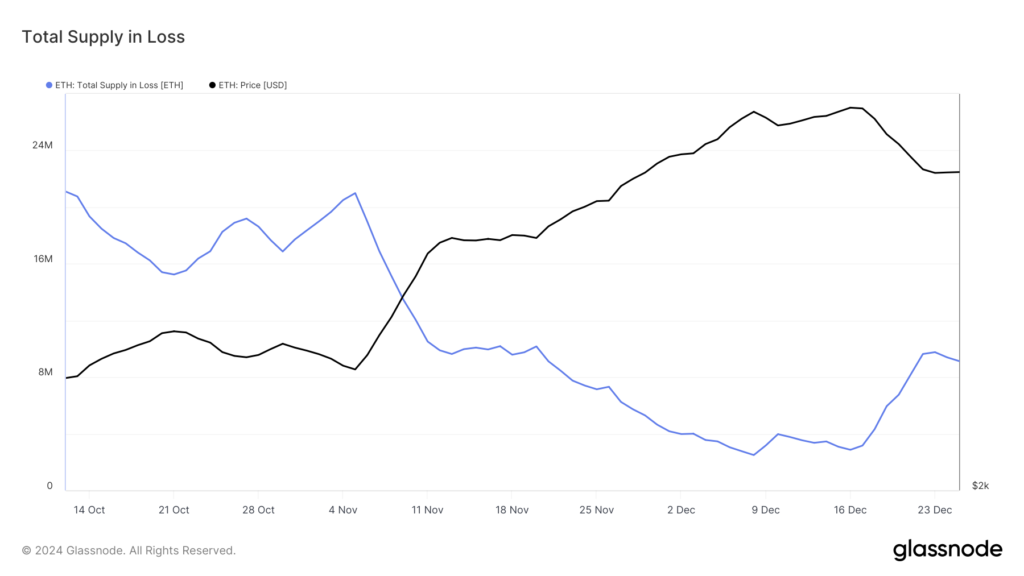

This past week, 7 million ETH entered the “loss” zone, skyrocketing unrealized losses to $23 billion—the highest increase in over five months. Investors seem to be moving toward selling rather than holding through the volatility, which has amplified the downward trend.

Profitability Sparks Selling Pressure

Nearly 28% of ETH addresses currently hold profitable positions, and historically, when this number exceeds 25%, more investors choose to sell. This adds to the current selling momentum, putting even more pressure on prices.

Key Levels to Watch

Ethereum’s current price action has left analysts laser-focused on two key levels:

Support at $3,327

If ETH dips below this level, it could break under $3,000, signaling a deeper bearish trend.

Resistance at $3,524

On the flipside, reclaiming this level as support might trigger a bounce back toward $3,721—offering some hope for recovery.

What’s Next for ETH?

The market is at a tipping point. Will the selling pressure subside, or will we see Ethereum’s price slide even further? It’s all about whether investor confidence returns or if bearish sentiment continues to dominate. For now, all eyes are on the $3,327 support level and whether ETH can overcome its current challenges.

Stay tuned for updates as we track Ethereum’s next move. Crypto markets are unpredictable, but understanding the key trends can help you stay ahead of the game.